Health Insurance – Securing the Pockets From Pricey Medical Expenses

Despite all of the hassles appearing inside the UK economy, a normal earning folks are finding safe investments within the insurance segment. Hence, the category of life, as well as health insurance policies, is proving themselves to become recession-proof. As per the recent reports, the masses are seen relying on the medical health insurance greater life cover. The reason for this development can be viewed in the working technique of the policies. A life cover is usually enjoyed with the policyholder’s beneficiary while; the cover could be enjoyed by the subscriber himself.

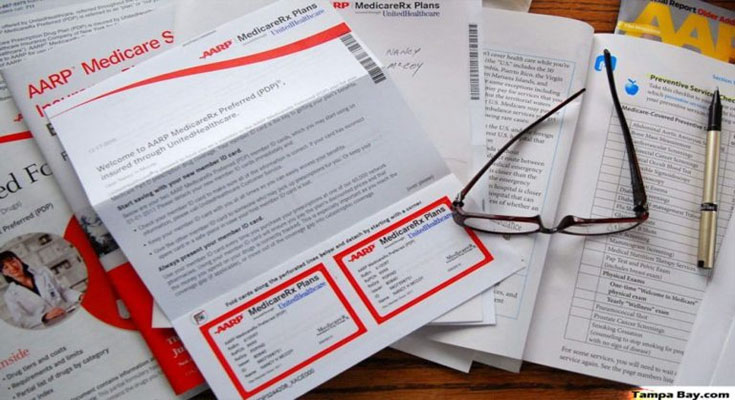

Looking at the enhancing demand for health care insurance policies, the service providers are discovering several types of policies. Firstly, policy providers are banking upon the standard health cover, where a policy is provided based on the premium paid by someone. Here, when someone gets ill, the insurance company comes with a claim utilizing a partial medical or …

Health Insurance – Securing the Pockets From Pricey Medical Expenses Read More